IMA India Research Reports

Friday June 16, 2023

India's Bottled Water Industry

The bottled water industry: Quenching India’s Thirst

- India, with 18% of the world’s population, has access to only 4% of the planet’s freshwater

- Less than 50% of the population has access to clean drinking Given this scarcity, India is now, unsurprisingly, one of the biggest consumers of bottled water.

- According to a UN report, India is the 2nd fastest growing market for mineral water, with a CAGR of 27%, right after South Korea (28%).

- Mounting concerns about the sustainability of packaged water may pose reputational and regulatory risks to the industry. However, the relative safety of packaged water and lack of low levels of access to reliable drinking-water supplies guarantee that packaged water is here to

Key Drivers

- Lack of safe drinking water: Inadequate access to clean water increases the demand for bottled water as a reliable

- Health Consciousness: The increasing trend of awareness towards health and wellness accounts for much of the industry’s

- Rising disposable income: The rapid growth in purchasing power in the middle- and lower-middle classes are driving demand and sales for packaged

- Nuclearisation and Urbanisation: As Indians urbanise and shift out of joint families, they levitate towards packaged water. This is because of the relatively high installation/maintenance costs associated with water purifiers and the relative ease of portable bottled water in rented

Water and Sustainability in India

Sustainability concerns surrounding the packaged water industry mainly revolve around the generation of plastic waste.

- India generates around 4 million tonnes of plastic waste annually of which only 30% is recycled.

- Notwithstanding a recent government initiative to ban the use of single-use plastics, PET bottles, the most common containers for packaged water, are not covered by the

The second source of concern stems from allegations of water wastage in the packaging process at bottling plants.

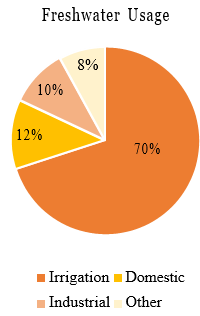

- According to India’s Central Water Commission, the bulk of India’s fresh water is used for irrigation, followed by domestic usage, industrial run-off and lastly other uses such as livestock, mining, power generation,

- The domestic alternative, RO filtration systems, lose 40% as

- Bottled water, processed through multi-stage filtration, actually generates less water wastage as the runoff is recycled.

Challenges Facing the Industry

- High transportation costs: Being a low-value high-volume industry, transportation costs account for a big share of the overall costs. A heavy reliance on trucks to transport bottled water across long distances and volatility in Indian fuel prices have significantly impacted

- Business continuity/Availability of groundwater: With 63% of India’s districts threatened by falling groundwater levels and a general decline in the availability of clean and safe drinking water, setting up water plants with reliable water supplies can be a major

- Regulatory Challenges: Stringent regulatory compliances imposed by the Bureau of Indian Standards (BIS) and the Food Safety and Standards Authority of India (FSSAI) can result in delays in setting up new plants and in framing expansion plans. Regulations on quality, packaging, labelling, transporting bottled water in specific quality and safety standard vehicles, and state-specific regulations on groundwater extraction adds to the costs.

- Packaging: The industry generates significant plastic waste, most of which is not

- Pricing: Price-sensitive consumers make it difficult for companies to maintain profitability while keeping prices affordable. In recent years, competition from smaller players offering products at significantly lower prices has affected sales and profit

- Knock-offs and Adulteration: Several local players produce fake bottled water products with similar names, Bislari instead of Bisleri. Not only does this undercut the market share of existing brands, adulterated water poses a health hazard that erodes brand reliability.

Addressing Sustainability Challenges

Given the lack of alternatives, bottled water is here to stay. However, going forward, measures that offset the environmental impact will make or break the industry.

- Use of alternate packaging materials such as glass bottles or the Tetra-packs that have driven ‘boxed water’ sales in the West could help reduce plastic waste. However these options are expensive for the end consumer and require huge investments in the recycling Glass bottles in the US have a recovery rate of 94% whereas India has much lower rates. Further, the relative weight of glass and cardboard may add to the already high transportation costs of packaged water.

Market leaders in the industry have launched several initiatives in order to offset their impact. There are many inspiring examples to ensure long-term sustainability such as:

- Bisleri’s ‘Bottles for Change’ programme partners with NGOs and waste management agencies to collect plastic across cities and convert it into flakes to manufacture non-edible products like cloth fabric, handbags and window

- Nestlé Waters aims to achieve 100% recyclable or reusable packaging by 2025 and has implemented initiatives to reduce the amount of plastic used in bottles. The company’s projects support reforestation efforts to prevent water run-off, wetland restoration, rainwater harvesting and drip irrigation to reduce water withdrawals, and invest in water stewardship

- Bisleri’s ‘Project Nayi Umeed’ conserves rainwater by building and restoring check dams, which store surface water for use both during and after the monsoon and help in recharging groundwater in the

Copyright ©️ 2021-22 INTERNATIONAL MARKET ASSESSMENT INDIA PRIVATE LIMITED. All rights reserved